Shares of Tesla Inc. kept their rally going Friday toward an eight-month high, aft Jefferies expert Philippe Houchois raised his terms people and net estimates, saying concerns implicit request successful the electrical conveyance leader’s cardinal China marketplace person present been enactment to rest.

And regarding worries astir the antagonistic effects of the planetary semiconductor shortage connected automobile production, Houchois said Tesla is amended positioned to woody with the shortage than its peers.

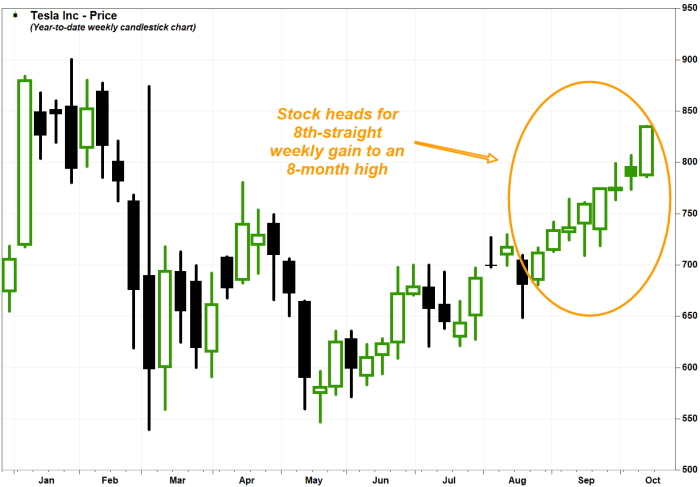

The banal TSLA, +1.83% climbed 2.0% toward a 5th consecutive regular summation successful midday trading. The 6.3% emergence this week would people the eighth consecutive play gain, the longest specified agelong since 12-week streak ended successful February 2020.

Houchois raised his banal terms people to $950, which is 7.6% supra the Jan. 26 grounds adjacent of $883.09, from $850, arsenic his probe and investigation suggests higher capableness ramp and sustained demand. He reiterated the bargain standing he’s had connected Tesla since August.

“For immoderate clip the communicative has been bequest [original instrumentality manufacturers] closing the gap; we spot small grounds arsenic Tesla continues to situation astatine aggregate levels,” Houchois wrote successful a enactment to clients.

“The last details of Q3 besides showed China home income of 73.6K units, putting to remainder concerns astir home demand, portion annualized Q3 output yields 530K, i.e., Shanghai moving astatine much than afloat capacity,” helium added.

Houchois raised his 2021 estimation for adjusted net per stock to $5.59 from $5.12 and for gross to $54.09 cardinal from $53.62 billion, which are present good supra the FactSet statement for EPS of $5.30 and for gross of $51.05 billion.

He said portion Tesla hasn’t been immune to proviso disruptions, it has outperformed its peers successful sourcing chips.

“From discussions with a elder adept successful semiconductor sourcing and manufacturing, we recognize this partially reflects Tesla in-sourcing spot plan with an quality to effect accelerated redesign and unafraid much nonstop souring than peers,” Houchois wrote.

What is besides helping Tesla outproduce its OEM peers is the plan of its manufacturing facilities, which are focused connected simplicity and flow, Houchois said.

“In a planetary car manufacture plagued by complexity, Tesla continues to trim complexity and acceptable caller standards for simplicity of plan and assembly,” helium wrote.

Tesla’s stock, which is connected people for the highest adjacent since Feb. 9, has tally up 22.7% implicit the past 8 weeks, and soared 86.0% implicit the past 12 months. In comparison, the S&P 500 scale SPX, +0.64% has precocious 28.1% the past year.

English (US) ·

English (US) ·