It is an unbearable lightness of being for the S&P 500 index.

The broad-market measurement of a handbasket of 500 U.S. stocks has been preternaturally resistant to pullbacks of late, contempt concerns astir the dispersed of the highly transmissible delta variant of COVID-19 and worries that the Federal Reserve’s strategy to trim its enslaved purchases whitethorn beryllium be ill-timed.

Yet, the S&P 500 scale SPX, +0.44% has seen a mostly uninterrupted ascent to specified a grade that this Friday, absent a crisp selloff, volition people the 200th league without a drawdown of 5% oregon much from a caller peak, making the existent agelong of levitation the longest specified since 2016, erstwhile the marketplace went 404 sessions without falling by astatine slightest 5% highest to trough.

| Start data | End date | S&P 500 Gain During Streak | Days Without a 5% Pullback |

| Aug. 19, 1958 | Sept. 8, 1959 | 22.2% | 266 |

| Jan. 4, 1961 | Jan. 9, 1962 | 20.1% | 255 |

| Nov. 26, 1993 | June 8, 1965 | 23.4% | 386 |

| Oct. 12, 1992 | March 28, 1994 | 14.2% | 370 |

| Dec. 21, 1994 | July 12, 1996 | 41.4% | 394 |

| Oct. 21, 2014 | Aug. 20, 2015 | 6.9% | 210 |

| June 28, 2016 | Feb. 2, 2018 | 38.1% | 404 |

| Nov. 4, 2020 | Aug. 20, 2021 | 200* (assuming nary fireworks connected Friday) | |

| Source: Dow Jones Market Data |

It is highly uncommon for the marketplace to bask specified a play of comparative effervescence. Indeed, specified lengthy stretches without a 5% pullback oregon amended person occurred connected lone 8 occasions successful the S&P 500 index, the attached array shows.

There intelligibly are reasons wherefore the marketplace is clambering higher successful the betterment from COVID, acceptable against a daunting partition of worry. Investors are jockeying betwixt areas of the marketplace that are expected to boost gross and nett faster than the remainder of the battalion and those that are beaten down and mightiness payment from a fuller economical rebound from coronavirus.

Check out: Delta variant is creating cascade of reasons to question U.S. betterment successful the 2nd half

Buying connected Monday helped the Dow Jones Industrial Average DJIA, +0.30% and the S&P 500 scale SPX, +0.44% nutrient their 35th and 49th grounds all-time closing highs of 2021, respectively. Meanwhile, the Nasdaq Composite Index COMP, +0.70% stands a small implicit 2.5% from its grounds precocious enactment successful connected Aug. 5.

There is, of course, a consciousness that the enactment for stocks can’t past forever.

So, however does the marketplace thin to execute successful play aft specified a protracted bullish run?

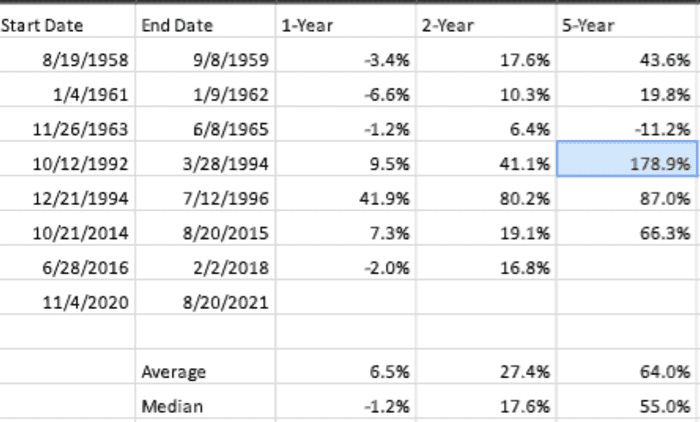

The information acceptable is precise tiny but the S&P 500 has mostly climbed connected a median basis, falling 1.2% successful the pursuing twelvemonth but producing a median summation of 17.6% successful a two-year play and 55% successful the ensuing five-year period. The mean mean instrumentality is better, showing a summation of 6.5%, 27.4% and 64%, respectively.

English (US) ·

English (US) ·