Global banal markets took a decidedly risk-off code connected Monday. The spark was the China Evergrande Group 3333, -10.24% crisis. Fears are rising that Evergrande is turning from a liquidity situation successful which the existent property elephantine doesn’t person capable currency to wage its obligations, to a solvency situation successful which the company’s assets are little than its liabilities if it is forced to fire-sale its properties.

In the U.S., the S&P 500 SPX, -1.70% had been mostly immune to Evergrande quality until Monday. The U.S. benchmark scale decisively violated its 50-day moving average. Investors are becoming spooked not lone implicit the anticipation of an Evergrande contagion but a looming situation successful Washington implicit the indebtedness ceiling.

Is this a buying opportunity, oregon a ace successful the dam that foretells disaster?

A home crisis

Take a heavy breath. An Evergrande illness is improbable to spark an emerging marketplace situation and contagion. That’s due to the fact that astir of the company’s debts are RMB denominated and small is successful U.S. dollars and different overseas currencies. Global markets person been comparatively unscathed by the crisis. There volition beryllium small planetary contagion effect due to the fact that it volition each beryllium contained successful China.

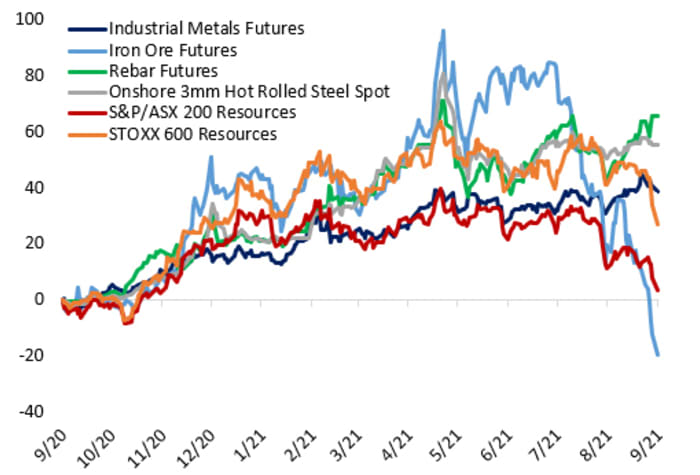

A fig of bearish investors person pointed to plummeting robust ore prices arsenic signs of slowing maturation successful China, which could person planetary repercussions. But George Pearkes at Bespoke pointed retired that alloy and different concern metallic prices are inactive holding up well.

So relax. Any contagion effect volition beryllium minimal.

A panic bottom?

In the U.S., the banal marketplace is starting to flash signs of a panic bottom. The Zweig Breadth Thrust Indicator has plunged into oversold territory, which is often a awesome of a short-term bottom.

My S&P 500 bottommost models are starting to flash bargain signals. The five-day RSI is profoundly oversold. The VIX Index VIX, +23.55% has surged supra its precocious Bollinger Band, which is different oversold signal. The word operation of the VIX inverted intraday, indicating fear.

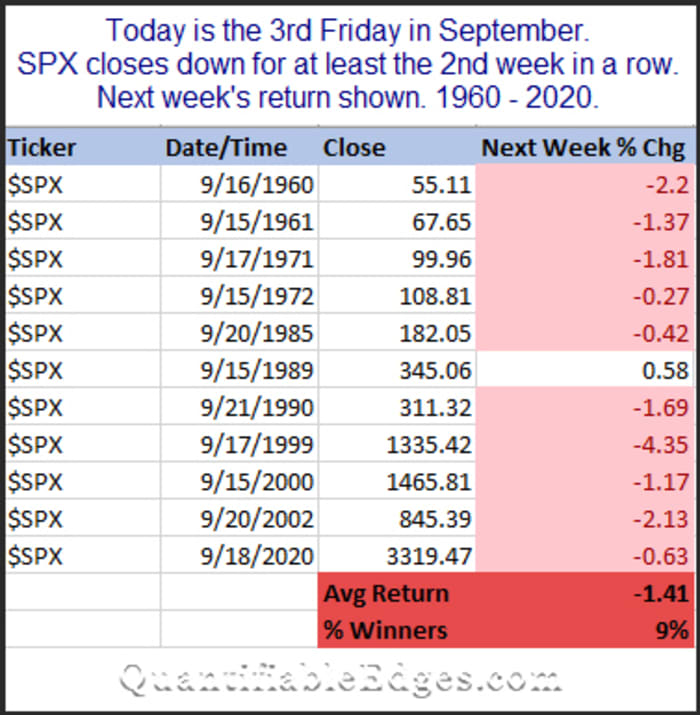

To beryllium sure, this week (the week aft September OpEx) is historically the weakest week of the year, arsenic documented by Rob Hanna astatine Quantifiable Edges. However, Hanna pointed retired that the mean play “weakest week” drawdown is -2.3%. As the S&P 500 was down 1.7% connected Monday, the scale is nearing its mean downside target.

While oversold markets tin go much oversold, a bottommost is near. Nevertheless, this marketplace isn’t without risk. MarketWatch’s Mark Hulbert studied the banal market’s instrumentality successful the 2 weeks anterior to debt-ceiling showdowns and returns person been disappointing. As well, the FOMC gathering this week could beryllium a root of volatility.

My interior trader plans to instrumentality an archetypal presumption connected the agelong broadside successful the S&P 500 astatine the unfastened connected Tuesday. This is simply a volatile marketplace and traders should size their positions accordingly. Be prepared for a short-term bounce, followed by a retest of the lows aboriginal this week oregon perchance adjacent week.

Cam Hui writes the concern blog Humble Student of the Markets, connected which this nonfiction archetypal appeared. He is simply a erstwhile equity portfolio manager and sell-side analyst.

More: Why Evergrande has abruptly exploded into a imaginable planetary fiscal marketplace crisis

Plus: Will Evergrande beryllium China’s ‘Lehman moment’? Wall Street says no

English (US) ·

English (US) ·